Note: “Obvious Pot Tax Opportunities Oddly Unaccounted For” is also Part 6 of Cannabis Commerce in the USA, found in its entirety here.

Question: if you write white papers for marijuana organizations, individual liberty organizations, or state governments, are you limited by code or oath to projections based exclusively on government statistics or previous literature?

If “yes,” why does Scott Bates’ 2004 The Economic Implications of Marijuana Legalization in Alaska, written for Alaskans For Rights and Revenues, introduce previously unmentioned revenue-raising concepts like “cannabis tourism” and “Alaska Energy Bars” (edible cannabis) to appeal to the “kayaker market segment?”

Just wondering . . . cause it’s baffling why highly intelligent, characteristically thorough economists have ignored the following easily-identifiable business and corporate taxation streams in their MPMTR (maximum pot-ential marijuana taxation revenue) forecasts:

- Big Pharma releasing a series of cannaboloids

- Big Food introducing a succession of edibles and consumables

- Big Agriculture instituting commercial hemp and marijuana farming

- Big Tobacco venturing into packaged cannabis cigarettes

- Business and corporate government receipts (state and federal income taxes, payroll taxes, Social Security, Medicare deductions) on a bigger scale than economists have thus far implied

- Revenue from leasing lands and other government initiatives

- Import/Export Taxes

- License Fees and Renewals

- Sales taxes collected at big box retailers, supermarkets, convenience stores, entertainment venues including spectator sports

- Marijuana stocks and commodities trading

- Cannabis and hemp cosmetics

- Cannabis academics

- Cannabis Tourism

The time has come for these to be addressed, analyzed, and accounted for.

We’ll come up with “ballpark” dollar amounts for each revenue source. Then, at the end of this section, we’ll add these figures to our core MPMTR estimate. Can we approach a “magic number” persuasive enough to hasten legalization? Let’s saddle up and see.

Big Pharma taxation

Big Pharma, with its history of churning out wonder cures, is poised to strike it rich with cannaboloids.

Think cannabinoids, healing products derived from various cannabis strains, targeted at healing/mitigating specific physical and mental ailments. With 18,000 studies (and counting) so far, the pharmaceutical and biotech industries are poised to pounce the nanosecond prohibition is repealed.

Can anyone dispute Big Pharma’s demonstrable knack for producing taxable income? Although it may have experienced a down season or two in recent years, Big Pharma is still a heavy hitter in anyone’s lineup. Here’s an industry that charges one price for horse medication, then ups pricing 2500% for the human version of the exact same drug. Cunning in its simplicity.

That strategy, and many more like it, showcase a mastery of sales psychology, proven over time to generate supersized profits. A little deviousness doesn’t hurt in the MPMTR game, either.

Jon Gettman, not one to casually toss billions around, admitted, “There’s a lot of money to be made by developing highly refined pharmaceuticals based on the chemical ingredients in marijuana. Yeah, there’s billions of dollars there.”

Does “billions” mean $2 billion or $20 billion? Let’s be conservative. Call it $3 billion.

Big Food and beverage taxation

Smoking marijuana has a downside.

Although it’s nowhere near as carcinogenic as, say, menthol cigarettes, ingesting any form of smoke affects lungs and lung-power. That puts quite a few people off, for good reason.

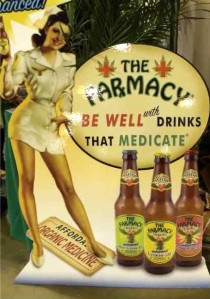

Hello edibles! Cookies. Brownies. Cereals. Tinctures. Extracts. Oils. Sodas. Problem solved.

State regulatory agencies, like the California Board of Equalization and the Colorado Department of Revenue ought to be licking their chops over this burgeoning category. The possibilities are endless for inspired products and marketing, providing a field day for food technicians, production teams, graphic designers, and ad agencies. Heck, it’s already begun.

Watch how creative this area becomes as enterprising minds infiltrate the kitchens of America like Rachel Ray on LSD.

Historically, Big Food, Cereal Division, has conjured up wacky monster-themed products like Count Chocula for General Mills, and timely products like Shredded Wheat, with boxes featuring idealized versions of the latest Olympic champions, for Nabisco. Sound familiar? It’s wacky. It’s timely. It’s. . . Canna Puffs? What’s to stop Big Food from exploiting THC (pot’s active chemical ingredient) – the most sensational ingredient ever? Talk about “Extra-Strength!”

Big Food is already doing boffo business with cannabis connoisseurs, providing Fruit Loops and Domino’s Pizza for stoners afflicted with the disorder colloquially labeled “the munchies.” Saving the populus from that dread malady not only makes money, it serves humanity, too.

But legalization will change the playing field entirely. Once John Q. Public can get fed and get high simultaneously (the possibility exists three blocks away from this keyboard), that’s evolutionary progress for mankind!

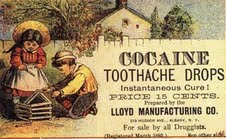

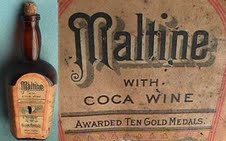

Precedence exists for edibles in the Food & Beverage industry’s pre-history.

If coke in wine was a go at one time, why not THC in wine now? “Double your pleasure, double your fun . . . “

The name “Coke” isn’t a coincidence. The popular soft drink once contained an estimated nine milligrams of cocaine per bottle, but it was removed in 1903. Most people don’t make the connection. Carbonated elixirs containing THC are already sold in dispensaries. It’s only a matter of time before they’re cloned and commercialized.

Legalization will also provide a quick pick-me-up for the candy industry. The common lollipop will enjoy a resurgence, if the popularity of that form factor at dispensaries is any indication, as will “fruit squares,” judged by the same criteria.

M&Ms may as well stand stand for “marijuana and munchies.”

You can conveniently carry these confections to the movies (or possibly buy them at the movies) and thrill to Avatar’s 3D effects without offending the churchgoing family next to you. Nice.

We’ve just futurized a little about what Big Food and Beverage could “bring to the table.” What about “Small and Medium Food and Beverage,” consisting of regional suppliers, restaurants, clubs, and coffee houses?

This industry could really use some good news; in recent years, economic reality has forced many people to cut down their fine dining habits. Here it is: for citizens thriving under the influence, stimulating the palette in the now takes precedence over storing nuts for the winter. If you stop by Broadway Wellness for some herbal releaf, there’s only going to be so many bistros you can pass up on your way home, even if you wind up blowing your utilities bill on dinner for two.

It’s pretty hard to argue against the fact that marijuana makes ordinary food taste good, good food taste great, and great food taste out of this world. That makes strapping on the old feed bag a necessity, not a choice. The food and beverage industry reaps the rewards.

At some point, restaurants will begin offering cannabis cooked in the food or in sauces — the equivalent of a “brandy sauce” — or au natural, for use in reserved rooms, mimicking heavily-ventilated cigar rooms. Did you want cream, sugar, or THC with that coffee?

Additionally, clubs and coffee houses à la Amsterdam will be getting into the act. Being able to take in some entertainment while “medicating” on site is a civilized pastime missing from “medical marijuana” clubs in the states. Prohibition has kept the emphasis on “patient care” to the exclusion of recreational use. Once that’s lifted, send in the clowns — night life is going to undergo psychedelic alteration.

“Out there” cannabis clubs don’t seem to have interrupted the fabric of daily life in Amsterdam. Far from it, they’ve added allure to the city’s desirability as a prime destination for cannabis tourism.

Eating will always play a main role in cannabis tourism. Just as surely as people travel to Sonoma and France for wine, and Scotland for single malt, they’ll be off to Alaska for the Matanuska harvest and to Humboldt County, CA, and Paonia, CO, for the fall festivals. Flitting from bud tasting to bud tasting, it’s hard not to work up an appetite. Count on some hefty tabs at fine dining establishments poised to capitalize. And some nice sales tax gains for local coffers.

Big Food and Beverage – not to mention Small & Medium Food and Beverage – talk about an area ripe for taxation! If this industry can operate freely, it will create all sorts of economic stimulation that doesn’t require a dime from Washington. Let’s “err on the side of caution” and rack up another $1 billion.

That figure looks silly low on this screen.

Big Agra taxation

Even without its star sibling, hemp alone could make agriculture sexy again. Hemp’s a variety of cannabis that contains minute traces of THC, 0.3% or less, not enough to “get you high” unless you take extraordinary measures . . . like hyperventilating in a burning field.

The hemp industry has unlimited upside because hemp has unlimited uses – from clothing to rolling papers to rope. An acre of hemp produces four times as much pulp as an acre of trees. It produces 250% more fiber than cotton, and 600% more fiber than flax when grown on the same land. It’s great for clothes, cosmetics, and oils.

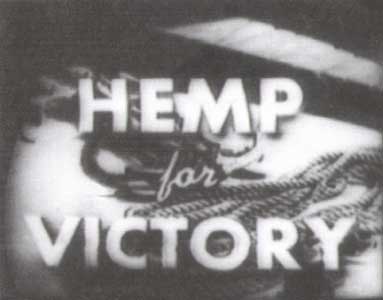

During WWII, the US government produced a propaganda film called Hemp for Victory, which encouraged farmers to grow as much as they could.

A simple Google search quickly ascertains that most of the founding fathers were hemp growers. With so many apparent benefits, so much glowing testimony from colonials who autographed the Declaration of Independence, and so little possibility of “copping a buzz,” hemp is a peculiar crop to ban. I can only think of one thing to do with a rutabaga, and it’s not banned.

Now, I’m not suggesting you tear up your lawn, plow furrows, then farm hemp to balance the family budget. I’m just pointing out it’s a handy substance with multiple virtues — one of which is producing taxable income.

Poteconomists disagree on hemp’s upside. Jeff Miron: “Hemp has had to be subsidized by every country that’s ever grown it.” Max Chaiken: “Hemp could become a major agricultural staple in addition to marijuana, creating even more jobs and generating higher levels of productivity . . . certainly these effects should be significant.”

Space prohibits debating hemp pros and cons to the nth degree; let’s just say there’s much glowing testimony to both its wonders and its potential for profitability and taxation.

Hemp is hopeful; as for large-scale commercialized marijuana “plantations” (greenlands?) . . . well, the sky’s the limit.

State universities will compete with Marijuana University, Oaksterdam University, and Greenway University (another revenue area, “Cannabis Academics,” could be created), offering students a specialized curriculum in commercial farming. Recently, the State of New Jersey asked Rutgers University to grow all the state’s medical marijuana. The school turned down that twist on higher education.

As for the “maragra” graduates . . . will they run massive outdoor plantations, in which case they’ll have to purchase tractors and every manner of farm machinery, stimulating those industries; or will they opt for indoor operations, in which case they’ll need lights, hydroponic supplies, and so much more. What about a combination of both? In that case, the greenhouse industry will move a lot units, too.

With dispensaries already coexisting nicely alongside hardware stores, it wouldn’t take much for folks in rural areas to embrace the idea of growing a miracle crop. Most farmers can do the math: tobacco = $4,000 an acre; cannabis = $4,000 a plant if you get the right plant in the right outdoor soil.

Think about the effect legalization will have on real estate values in rural areas, places where there is little or no upward pressure buoying raw land values. If you’re Farmer Jones in certain red states with prime agricultural land, perhaps a tripling of your property values, along with the sudden and welcome appearance of actual prospective buyers, piques your interest? It’s OK to be pro-life and pro pot. You won’t be the first, as we’ll find out in Part 10.

Large scale commercialized operations will be launched. They may be supplied by seed-company-from-the-dark-side Monsanto, not a company fond of sharing the wealth or playing nice with competitors – but an entity adept at creating taxable profits.

Hemp cultivation, commercialized cannabis farming operations, agricultural education, land sales . . . what’s all that worth? Think of it this way: how many farmers do you know? You’ll know a bunch when folks can start planting acres of kush as high as an elephant’s eye.

And this is all worth? I’m going really easy here since I’m not attempting to “prove” guesstimates via dozens and dozens of footnotes. Let’s stay ultra-conservative. Tack on another $1 billion. I’m not used to being this conservative. It’s like walking around in plaid pants.

Big Tobacco taxation

Does anybody really believe that Philip Morris, Brown & Williamson, R.J. Reynolds et al will abdicate the potential weed windfall to a bunch of hippies, Deadheads, and stoners?

Don’t bet on it.

Here’s an industry that knows everything there is to know about growing a brand. Free to train its guns on the cannabis crowd, Big Tobacco’s corporate psychologists will devise imagery and iconography every bit as seductive, insidious, and persuasive as the Marlboro man.

Get ready for the “Marlijuana Man” riding the range ’round sunset.

The tobacco industry is notoriously tight-lipped. No other industry makes employees sign more non-disclosure agreements. That’s a good business practice when your industry’s been accused of selling addiction, disease, and death. While that’s all true, it’s also true that the former Tobacco Institute comrades grow it, package it, market it, and profit from it awfully well.

Farm-minded Jon Gettman is from Virginia, a major tobacco producing state, and he hasn’t heard any leaks from Big Tobacco – to this point. Tight-lipped or not, it’s a given the cannabis question has been broached in Big Tobacco boardrooms. Every tobacco company has a fiduciary agreement with its shareholders to maximize profits. So forget the idea that rolling trillions of cannabis cigarettes in the machines it already owns is too controversial.

Marijuana has important implications for the tobacco industry in terms of an alternative product line. Tobacco companies have the land to grow it, the machines to roll it and package it, and the distribution to market it – a 1976 report prepared for the Brown and Williamson Tobacco Corp. by Forecasting International, Ltd.

The industry already has allies in state governments:

The National Conference of State Legislators last month said states were facing combined deficits of more than $40 billion in 2009, and increasing tobacco taxes “is one way some states are trying to make up the shortfall,” The New York Times reports. Last year, states collected more than $19 billion in cigarette taxes. Ten states increased their cigarette taxes in 2007, and more states are considering increases this year.

The government “has become a financial stakeholder in smoking, some would argue, even as public health officials warn people about its deadly consequences.” –Stephanie Saul, TheNew York Times, 8/30/2008, “Government gets hooked on tobacco tax billions.”

My money’s on Big Tobacco growing into a primary source of taxation revenue. Cigar makers could aid the cause, expanding their product lines by introducing “big phatty” cigars – perhaps in collector cigar boxes.

Cannabis Commerce will monitor Big Tobacco as it transitions from black lung to green rush.

I’ll break from the conservative mold on this one. If, according to The New York Times, states made $19 billion from cigarette taxes in 2008, chalk up at least $2 billion a year for “industrial” cannabis. That’s just from existing tobacco companies. New marijuana-only manufacturers will rise up to compete with them. The transition will take a few years, and then it’ll be onwards and upwards.

But hold on – some economists, the ones that don’t smoke, don’t grow, don’t book passage on icebreakers to follow the Grateful Dead to Antarctica, and don’t live anywhere near a dispensary, will scream “that’s not more demand, or more tax money; that’s revenue from people switching from unpackaged bulk buds to packaged “cigarette’ cartons, or from beer drinkers shifting some outlay from alcohol to cannabis.”

OK, since when has the tobacco industry not demonstrated an uncanny knack at recruiting new victims . . . I mean customers, even without the benefit of advertising? Since never. I have a lot of faith in this industry cause it takes a little more finesse to sell what is sells than Girl Scout Cookies.

I’ll stick with the $2 billion. That seems excruciatingly frugal, but so be it.

Import/export taxation

Pressed bricks of Mexican commercial weed. What if the guard with an M-16 was a tax collector with a pencil instead?

Think Dos Equus, Chivas Regal, Sapporo Draft . . . and substitute Panama Red, Thai Sticks, and Afghani Skunk.

Speaking of the last strain, the US government appears determined to prevent Afghani “insurgents” from raising poppies (heroin) to finance “terrorism.” These people might prefer being repurposed as cannabis cultivators to obliteration.

Cannabis cultivation has been a cornerstone of their traditional economy for centuries. “Skunk” derivatives are valuable native crops that tribespeople could export and we could import . . . charging them import taxes for the privilege.

Other countries closer to home could benefit from that sort of trade arrangement, too.

There might be some interested parties in Canada and Mexico. Mexican president Felipe Calderone, tired of the costs and violence associated with taking on drug cartels, is already posturing to legalize all drugs. Canada, on the whole, is a live-and-let-live place which takes national pride in its BC Bud.

Working out a trade agreement between North American countries is in everyone’s best interest. Of the big three, Mexico particularly can ill-afford to keep forfeiting the tremendous amount of export taxes it loses on bales and bricks of ganja that cross its northern border on a daily basis.

What if import taxes were placed on all the marijuana currently coming into the USA from countries with shared borders? That’s around 10,000 to 15,000 metric tons times whatever the rate would be . . . it’s dizzying. What if import taxes were placed on half that amount? That could be a positive development, indeed.

Central American countries are quite capable of growing world class product too. They could all use the export taxes that could be generated by shipping choice strains to the US and Canada. They already do well with the coffee trade. International cannabis commerce will help them even more.

Regarding exports, consider our nation actually taking the lead in at least one segment of the modern-day spice trade — a novel thought. According to the Commerce Department, the 2008 US trade deficit on international trade in goods and services was a staggering $677.1 billion. Marijuana exports could only reduce the trade deficit so much, but why not get the ship heading in the right direction?

Here’s a chance to do just that. We’ve got the technology. We’ve got the know-how. Remember “American ingenuity?” How about just plain sensibility — taxing exports to countries that hop on the legalization bandwagon, too?

There’s a possibility that we could be exporting choice strains and importing choice strains. It’s a wide world of the unknown. Where could it go? How much could we get at the border for imported product and how much could we get when it’s sold at retail level. Really, there’s some potential there. –Max Chaiken

What’s that worth in dollar amounts? This is a potentially lucrative area that will take time to ramp up. It also requires international cooperation, an oxymoron. Let’s call it $250 million – a drop in the bucket compared to what cartels are making in the illicit market. It’s insane to let imports and exports go untaxed a moment longer.

Revenue from leasing lands and government initiatives

Are there precedents for Big Government competing with the same private sector it taxes? Think T-bills. Think US Savings Bonds. Think leasing lands for cattle grazing. Think leasing lands for oil and gas exploration. Think state lotteries.

Gettman’s work is notable for its revelations about the many Johnny Weedseeds sowing clandestine plots on national forest lands. If you can’t fight ‘em, why not join ‘em? Just go the other direction entirely, offer security services for growers ponying up to farm government-controlled fields.

Don’t burn it, make some money from it! BLM, the Bureau of Land Management, already has the infrastructure in place. National Guardsmen could provide the security.

State parks could use the extra income too.

Even if prohibition is repealed, there would still be jail time for growing on public lands. Wouldn’t it be worth paying a fraction of the profits for a get-out-of-jail free card? I’d make that trade in a heartbeat.

While it’s unlikely to happen, what if the federal government decided to raise its own brand? The visage of Uncle Sam sternly declaring “I Want You” from a coffee-can sized cannabis canister screams appeal. Growing an Uncle Sam brand, or the State of Wyoming’s Old Faithful brand, may be unnecessary, because, as Jeff Miron points out, the feds can just tax operations without having to do the work. But if they want to do the work, the profits are potentially greater than the tax revenue.

In case the concept of growing money instead of paying out $15 billion a year in farm subsidies seems like too much of a “pipe dream,” it shouldn’t. The US Government already maintains “the Ft. Knox of dope” at The University of Mississippi in Oxford, and has done so since 1968 under the auspices of the National Institute of Drug Abuse. Its Research Institute of Pharmaceutical Sciences is the only legal marijuana plantation in the United States. The Institute maintains seven acres of indoor and outdoor crops, rolling its harvest into cigarettes using machines appropriated from the tobacco industry.

Another well-known model of government investment in typically private enterprises could work. Consider the “lottery model” put forth by attorney Richard Evans, writing for cantaxreg.com:

Consider not a commodity, but an activity, and a recent and well-tested model springs to mind. Historically, nearly all forms of gambling have been prohibited in America. Starting with New Hampshire in 1964, however, over forty states have created their own lotteries. State employees run them and all earnings, after expenses and prizes, go to the public coffers. Competitors remain illegal. Only certain functions, like providing the software, are contracted out to private companies.

Applying the lottery model (a public monopoly) to cannabis, one can visualize farms and greenhouses owned by the state, sending their product to processors, thence to distributors, thence to retailers, all staffed by state employees. The retail price would nimbly rise and fall with the market.

It’s difficult to predict how active various government branches would be. Governments can always “farm out” leasing and/or growing operations to private concerns, as in the lottery model.

Things could take a surreal turn if marijuana became legal and the government subsidized farmers not to grow it!

Leasing lands definitely has considerable upside. The concept of government grown herb may never see the light of day, but it has upside. There’s some tax money to be gained here: another $1 billion doesn’t strain the imagination.

Licensing fees and renewals

Chaiken mentions these in passing, no mention at all from the better-known poteconomists.We’re talking about licensing income for cities, counties, and states.

The magnitude of this income is contingent on whether medical marijuana models stay in place under legalization. If they do, those $100 or so medical marijuana licenses represent a swell source of “petty cash” for state coffers. The 150,000 (and counting) license applications the State of Colorado’s received add up to around $13.5 million at $90 per license per year, or the equivalent of around 3,750 teachers’ salaries. Of course those licenses will be annually renewed, keeping those teachers in the classroom.

If the constructively compulsive Jon Gettman is correct, that there were 41.8 million users in 2007, and if I am correct, that the tremendous amount of free advertising and publicity cannabis commerce has received since 2007 (which is documented in the next three parts of this report) amplifies this number at least 10%, then there are around 46 million “users” in the USA.

If half of them applied for medical marijuana licenses, at around $100 per license, that’s $4.6 billion right there — three quarters of the way to the $6.2 billion total MPMTR forecast by Jeff Miron and the RAND corporation team of Caulkins and Pacula!

Is it conceivable that a high percentage of marijuana consumers would pay $100 annually in exchange for immunity from incarceration? That’s a pretty good tradeoff. Will some of these people be buying “a license to party?” Why, yes. And exactly what is wrong with that? There’s a valid medical argument for legalization, and there’s a legitimate recreational, “right to party,” argument.

Buying a license to kill fish and game is recreational, not medical. I fail to see why one is currently legal in every state, while the other is partially legal in a few states.

Then there’s a nice little revenue stream selling dispensary licenses, which mimic the model of liquor licenses. Dispensaries pay the city of Denver $2000 just to apply and another $3,000 (annually renewable) if their application is approved.

That’s just for the City of Denver. With HB 1280, the State of Colorado has seen the light. It’s already extracting dispensary licensing fees, too.

Here are some sample State of Colorado annual fees:

0-300 patients = $7,500

301-500 patients = $12,500

01 or more patients = $18,000

Cultivation License (per location) = $1,250

Infused Products (license to sell edibles) = $1,250

The state has frozen the number of dispensaries at around 700 for a year, pending further “study” (or shenanigans; read Part 11 for the inside scoop). Let’s say each one pays an average of $13,000 a year in state fees alone. That’s about $9 million right there — and that’s with the number of dispensaries frozen, and with many populated areas of the state effectively banning dispensaries locally, despite the fact the state recognizes their ability to exist. That $9 million could only swell once the freeze is lifted and the rest of the state gets with the program.

Predicting licensing fees is confusing because, depending on where you live, sometimes there may be local (city) fees, there may be county fees, and there are may be state fees.

Check this abstract wording from the California Department of Public Health:

The state portion of the Medical Marijuana Identification Card (MMIC) application fee is currently set at $66.00 per card for non Medi-Cal patients and $33.00 per card for Medi-Cal patients. The counties then add their administration fee to the state cost. Both the state and counties have authority to cover their expenses through application fees, therefore, established fees will vary by county. Please contact your county program to find out what the total cost for a MMIC is in your county.

In LA proper, under a plan approved in April 2010, dispensaries will have to pay almost $1,600 in fees in order to operate legally. Included is $688 for building and safety permits, and $151 for a police background check.

With respect to the present incongruous situation, that is, the random medical marijuana regulations reigning in the fourteen states that presently permit at least some type of cannabis commerce, it would take a power higher than human prognostication to accurately predict how much revenue licensing fees could produce.

Additionally, no one really knows if the dispensary (aka collective, co-op, club) or medical marijuana models will survive in a legal, regulated landscape. That’s OK, because if those models are abandoned, in all probability, a new series of fees will take their place, or coexist alongside them. For instance:

- Restaurant licenses

- Café licenses

- Licenses for supermarkets and big box retailers

- Licenses for convenience stores

- Liquor store licenses for “one-stop shopping”

- Farming licenses

- Retail distribution licenses

- Personal cultivation licenses

- Training certification for medical marijuana providers

And so on. There’s no shortage of fees that will be assessed. Jeff Miron will begin accounting for licensing fees in his reports. “No, that (licensing fees) is not in the report. I agree,” he told Cannabis Commerce.

How much should we tack on for annual fees? I’d be shocked if there wasn’t $2 billion nationwide in a totally legal, regulated landscape. Easy.

Revenue from marijuana stocks and commodities trading

With all respect to pork bellies, with the nation prepping topsoil for America’s #1 cash crop, can anyone believe marijuana would not be one of the most active commodities traded on the exchange?

With all respect to pork bellies, with the nation prepping topsoil for America’s #1 cash crop, can anyone believe marijuana would not be one of the most active commodities traded on the exchange?

What kind of taxable income could cannabis . . . the commodity . . . actually produce? Perhaps someone(s) with commodity trading experience will chime in here. This area seems ripe. Taxation would take the form of state and federal incomes taxes paid on profits from trading. Ditto for profit taking from the appearance of marijuana stocks like Cannabis Science (CBIS), Cannabis Medical Solutions (CMIS), and Medical Marijuana, Inc. (MJNA) – wending their way from the wilds of Humboldt County to Wall Street.

I also wouldn’t be surprised to see marijuana stock funds make their appearance. These would be offered in the same manner as other “green” funds, if not combined with them.

Once again, economists can play devil’s advocate: “If people are buying marijuana futures, they’re not buying pork belly futures . . . so we’re not really generating more tax money.” OK. What if someone, who never had any interest in commodities before, decides to jump in because he’s bullish about marijuana? Then it’s not “shifting,” it really is new business.

I pass, for now, on placing a dollar amount on the tax revenue marijuana stocks and marijuana commodity trading will produce. It’s too early, it’s too speculative, and this chapter is long enough without exploring the vagaries of commodities markets.

There’s decent potential here.

Government receipts: individual and business state and federal income taxes, payroll taxes, Social Security, Medicare deductions

Glaringly absent from The Other Green Economy. Way undervalued by Jeff Miron. Jon Gettman, to his credit, did account for these (while inexplicably ignoring sin taxes).

The “Al Capone factor” is an awful compelling reason for, let’s say, cultivators to come in from the cold and file Schedule F (for farming) tax returns – which accountants started seeing in 2010. The category is actually “grass,” as in hay.

Many well-known white papers account for individual “government receipts.” Business or corporate government receipts may be implied in their papers as “percentage of GDP.” However, as pointed out last section, we learned that some levels of wholesaling are not properly accounted for at all. Several people often make money from the same parcel of pot. Payroll taxes are factored vaguely, if at all.

Once businesses of every size get into the swing of cannabis commerce, significant amounts of business taxes will find their way into local, state, and national coffers. How significant? This area requires more study, but it has to be worth $2 billion in the short term.

Once the industry takes the training wheels off, that number could skyrocket.

Cannabis and hemp cosmetics

Creams. Lotions. Ointments. Salves. Oils. Butters. Balms. Sprays. Waxes.

If you can’t smoke it, eat it, or drink it, no problem, we know where your bloodstream is, and we’re coming in.

The cosmetics industry has a nice track record, generating record sales to an increasingly fearful public. The public is increasingly fearful because the industry is practiced at scattering fear seeds far and wide, in newspapers, magazines, radio, television, and the internet. Fear of aging. Fear of being a gram or two overweight. Fear of loneliness. OMG.

Many infomercials that succeed in the “beyond their wildest dreams” category sell some form of cosmetics. Imagine teaming the right celebrity sales team with the right cannabis cosmetics and the right fountain-of-youth promotion. Therapeutic variants will be sold as anything from pedestrian “pain relief” to “astonishing miracle cures.”

I’m making fun of the expected chicanery. But there’s nothing particularly funny about the actual pain relief these products are already providing at dispensaries that offer physical therapy. Practitioners trained in using cannabis preparations for what-ails-you are already using these successfully – and patients are coming back for more.

There are already boutique cannabis cosmetic sales. I’d be surprised if ambitious and enterprising cosmetic conglomerates don’t hit the jackpot with an unending series of innovations. Someone’s sure to come up with a multilevel marketing version.

Exactly why wouldn’t there be millions if not billions in tax dollars flowing from the fountain of youth? I can’t think of any reason. I’m predicting a half-billion in cannabis cosmetics taxation, leaving room for growth.

Revenue from cannabis tourism

Sorry, Rembrandt. More people visit Amsterdam for the hashish cafes than the “old masters.” Why not? Cannabis tourism is spreading to the four corners of the earth.

According to greensmokeroom.co.nz:

The fact is that many travelers don’t just come to South Africa for the spectacular scenery or to visit Nelson Mandela’s Prison Cell on Robben Island or to experience the wall-to wall wildlife – many come to sample some of its more exotic, natural produce – cannabis sativa – known in South Africa as dagga. In fact these travlelers become members of the growing cannabis tourism fraternity. Durban Poison (DP) is the visitor’s choice.

Of course “the good old USA” has its own natural attractions. How far is the leap of logic from Napa = wine country to Humboldt = marijuana country? Not very!

The Bed and Breakfast industry will be rejuvenated as enterprising establishments like “Bob’s Bong and Breakfast,” adjacent to the Land Of The Giants redwood forest, offer hospitality for the happily sedated. Guests can select from menus poetically modeling single-malt Scotch descriptions at fine dining establishments. When guests tire of these charming inns, they can wander from estate to estate for tastings, just like those romantic couples touring the wine country. “Ah, yes, the west side of the budyard.”

This area pales in comparison with the previously detailed heavy hitters, but, hey, petty cash comes in handy for repairing the odd bridge or tunnel. Let’s call it a $250 million stream. Every little bit helps.

Big box retailers, supermarkets, convenience stores, entertainment events

Consider a world in which marijuana products are available at the country’s gas stations, convenience stores, supermarkets, big box retailers, and anywhere alcohol and tobacco are currently sold, including concerts and sporting events. Close your eyes and visualize Dooby Queen and Best Bud, awaiting your patronage at highway interchanges.

But is bigger better? Wouldn’t Best Bud just divert sales tax away from little dispensaries to big chains? Yes and no. Yes because it would to some extent; no, because big boxes attract a different sort of customer.

Lots of people will be ecstatic that the uplifting herb will be sold at entertainment events including spectator sports. These would likely take edible form, although it’s certainly possible concert venues and sports arenas will establish special smoking sections. How silly is not selling marijuana at rock concerts? That should be a crime. And won’t Monster Truck Spectacular be just a tad more thrilling with than without?

Ah, spectator sports. I can see it now, the deluded fan running out on the field to attempt a game-winning field goal for the Broncos. “But officer, I know I could have nailed that 58-yarder!” Pot and pro sports is actually not a hallucination: for decades, the Jamaican national soccer team has been playing World Cup qualifiers in a ganja haze.

If alcohol and tobacco can be sold at convenience stores and supermarkets, do you think these consumer magnets will draw the line at marijuana? What line is that, again? I seriously doubt many owners, already in the alcohol and tobacco business, will eschew certain profitability.

Then what sort of sales tax, not to mention government receipts, could be generated by big box retailers, supermarkets, convenience stores, and entertainment venues including spectator sports? Some bullishness has to escape: $3 billion.

A special word about cannatax

I can’t conceal the fact I get a kick out of locating taxation streams poteconomists have never waded in before. That said, there are certain people who should never have to be pay any cannatax. I’m talking about folks with huge disabilities and minimal incomes. They should be tax-exempt.

Also, while I believe there is every reason to assess fees for various cannabis licenses, I don’t advocate setting these so high that mom & pop shops can’t get in the game — or are forced out of the game, as recently happened in Colorado.

Space prohibits editorializing and strategizing further about these issues; suffice it to say the human factor must be considered, too.

Conclusion

This round-up represents some obvious taxation possibilities that have been under-discussed, to be charitable. There are more potential taxation revenue streams highly respected studies haven’t even mentioned, much less reconciled, in their forecasts. How do I know? While I’ve given it a mighty effort, I greatly doubt I’m brilliant enough to identify them all. So, what am I missing? All comments welcome.

As we stand, $17 billion of perfectly plausible cannatax has been counted in this section — that’s been ignored by minds that don’t miss much. Adding that to the Cannabis Commerce core estimate of $50 billion we established last section brings our total to $67 billion. If I was a politician sitting on the fence, that figure has a tantalizing quality to it.

Does that mean we’re done? Have we come as close as possible to predicting MPMTR in Stardate 2010? No and no. This section didn’t even talk about sales tax and sin tax, because these obvious pot tax opportunities have been traditionally addressed by poteconomists.

Finding more MPMTR takes moving from the left side of our brains to the right:

Coming up with more meaningful computations is going to take qualities like imagination, street smarts, vision, ingenuity, and an ability to futurize. A sprinkle of deviousness, like some of the concerns mentioned in this section capably demonstrate, won’t hurt. It’ll take envisioning a post-legalization landscape ripe for a succession of enterprising and entrepreneurial ideas – all infinitely taxable.

Futurize along with me now. Picture springtime for graphic designers, as gaily-wrapped cannabis consumables beckon from billboards. Notice alluring little packets, conveniently placed by cash registers, programmed to collect sales tax for the newly renamed Bureau of Alcohol, Tobacco, and Marijuana. Can you see yourself at a pot tasting? These will be as common as wine tastings – if they’re not already.

What else do you see arching skyward, alongside the amber waves of grain, swaying sunflower-like under an azure sky? Could it be Field of Dreams, cannabis style?

Futurizing allows us to preview a more luminous lifestyle, replete with ample funds reaped for the public good – picture the Atomic Age with good buds.

Forecasting MPMTR isn’t just about rehashing NSDUH surveys and seizure statistics, is it?

Next section preview

Not accounting for obvious tax possibilities in the legal, regulated landscape is a factor limiting current pot tax predictions. Another is failing to account for the thriving cannabis commerce already occurring in medical marijuana communities, in states fortunate enough to have retail dispensaries, cultivation shops, and other emerging forms of commerce. Some areas have surpassed “already occurring” and “emerging.” There’s only one word for them: exploding.

Take my hood, for instance . . .